Investor Overview

Welcome To Eagle Royalties

Eagle Royalties is another Eagle Plains Resources spin-out company. Eagle Royalties (CSE:ER) was created by way of plan of arrangement in Q2 2023 with the bulk of Eagle Plains' mineral royalty assets. The spin-out was conducted to spotlight the value of these royalties, reward shareholders of Eagle Plains with a new share on a 1 for 3 basis and to make these assets readily available for acquisition.

Eagle Royalties flagship is the AurMac Royalty that overlies a significant portion of Banyan Gold Corp’s gold discovery at their AurMac Property located in the central Yukon Territory.

Corporate History

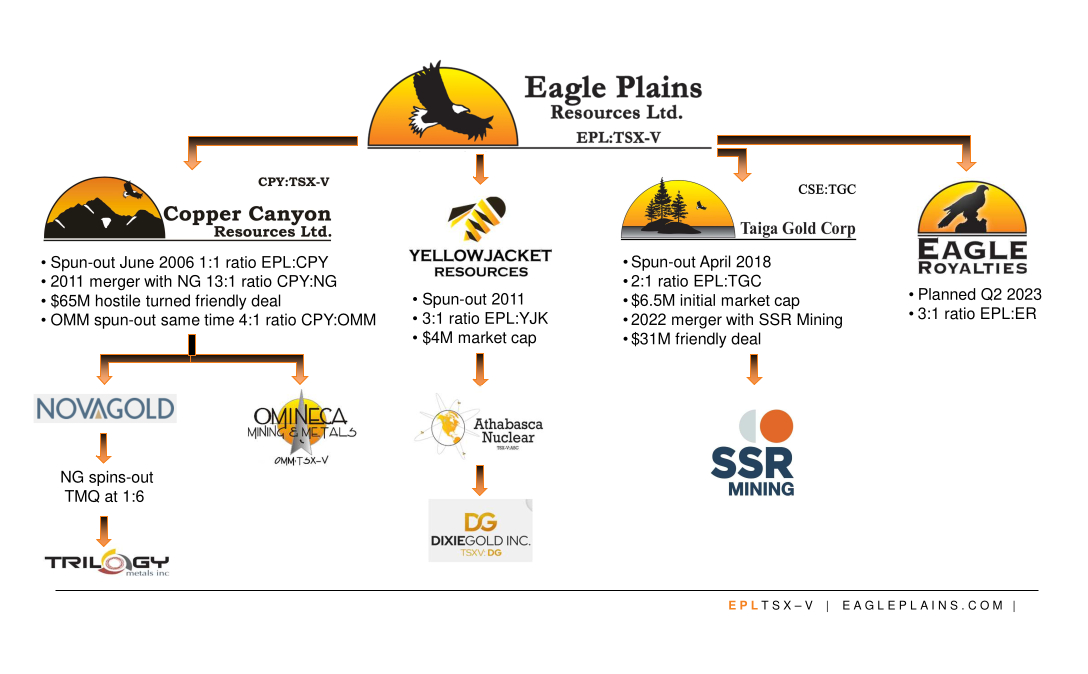

Eagle Royalties Ltd. was created in May 2023 from the spin-out of over 50 Eagle Plains Resources (TSV-V:EPL) royalty assets located across western Canada. The parent company, Eagle Plains Resources, has been operating as a mineral explorer in western Canada since 1992 and has performed 4 spin-outs since 2006 including the latest, Eagle Royalties Ltd (CSE:ER).

These spin-outs were intended to make the associated assets available for M&A activity. This strategy has resulted in over $100,000,000 of value being created for the shareholders of the first 3 spin-outs.

Objective

The primary corporate objectives of Eagle Royalties are to:

- enhance shareholder value by spotlighting these royalty assets in a stand-alone company

- Add value through royalty acquisition

- Package royalties for M&A

The Royalties

Since its formation in 1992, Eagle Plains Resources has been assembling a large portfolio of mineral exploration royalties and had secured royalty interests over a wide range of commodities located in areas of active mining and advanced development such as the flagship AurMac Royalty that overlies portions of Banyan Gold Corp’s gold discovery at the Aurmac Property as well as a group of Hecla Mining’s claims in the Keno Hill District. Other royalty areas include claims at Eskay Creek operated by Skeena Resources, Patterson Lake South operated by Cameco and Denison and numerous other royalties located throughout western Canada.

While Eagle Plains held many of these royalty interests for years, management was of the opinion that their true value is not reflected within the diverse holdings and activities of Eagle Plains Resources and their potential would be more readily identified as a stand-alone company.

What is a Royalty - Net Smelter Royalty (NSR) Explained

According to Wikipedia, a Net Smelter Return (NSR) is the net revenue that the owner of a mining property receives from the sale of the mine's metal/non metal products less transportation and refining costs. As a royalty it refers to the fraction of net smelter return that a mine operator is obligated to pay the owner of the royalty agreement. The royalty is paid in variable or fixed payments based on sales revenue received by a mining operator in return for mining output. It is contingent only on the sales price and quantity of product sold.

The term is named so due to the fact most of the time, mining output sold requires further processing by smelters; the mining products purchased directly by smelters are sold to them for a discounted (net) price based on how much further processing is needed. The mining lease specifies the selling price (prices are different in spot and forward markets) and is used to verify the exact amount of product that's produced and sold between royalty payments.

One advantage NSR royalties have over other royalties is that usually, payments are higher in the short term because capital costs and exploration costs cannot be used as deductions (some royalties don't have to be paid until after other costs such as loans/amortization are taken care of). Also, mine life and royalty expiration dates need to be taken into consideration. The royalty can be called a Net Value Royalty when deductions are based solely on the contract.

Alternatively a Gross Smelter Return is a percentage of gross revenue paid by mine owner that isn't subject to any deductions.

Eagle Plains Spins-out Eagle Royalties Ltd.

For more information about the spin-out Plan of Arrangement the made Eagle Royalties Ltd. please visit the following link:

Eagle Royalties Ltd. Plan of Arrangement - Accounting Information

For accounting purposes the adjusted cost basis (ACB) of the Eagle Royalties Ltd. share is to be 33.54% of the pre-split Eagle Plains share purchase value.

Investor Relations Resources

![]() Eagle Royalties Corporate Brochure 2024

Eagle Royalties Corporate Brochure 2024

Sign up to receive our investor information package for Eagle Royalties»

For more information, please contact:

Mike Labach

Investor Relations Manager

Phone 1.866.HUNT ORE / 1.866.486.8673

Email: mgl@eagleplains.com

Updated February 6, 2024